Percentage of profit

Also the accounting for gross profit vs mark-up are different. Behavioral health and emergency medicine and.

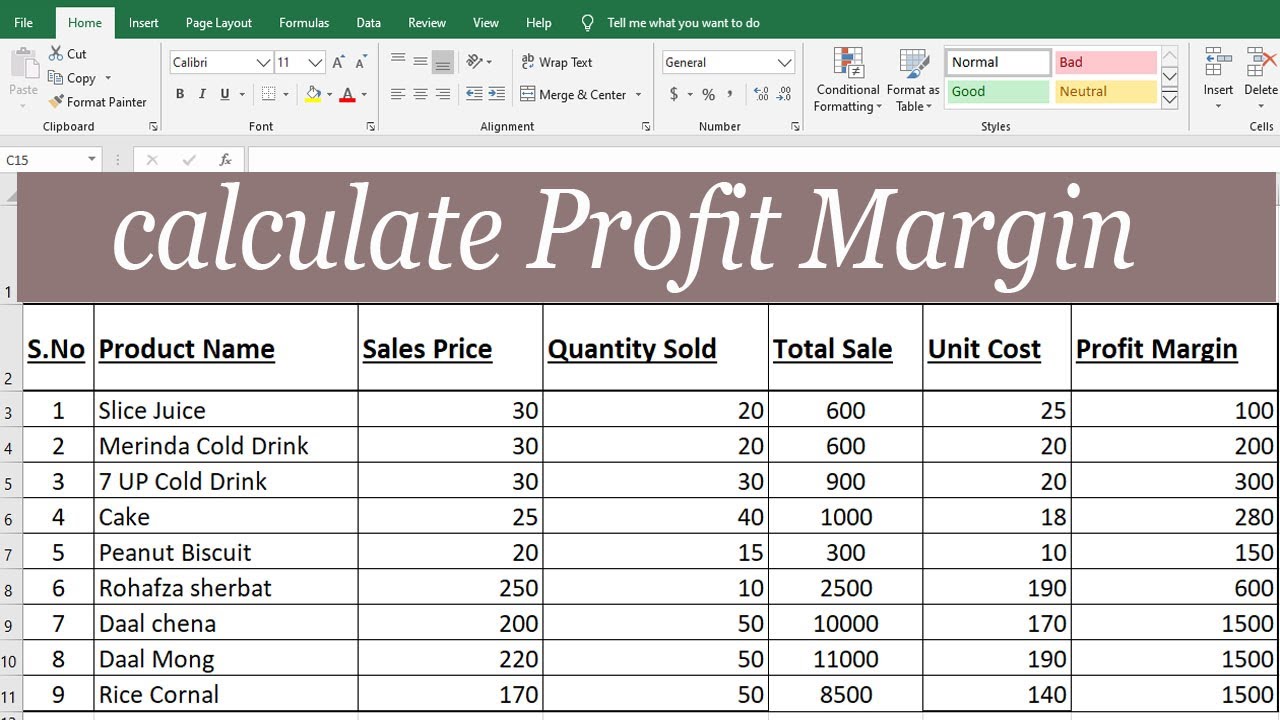

Calculate Profit Margin With Percentage In Excel By Learning Center In U Excel Tutorials Learning Centers Excel

Chapter 10 Profit and Loss Ex 10B.

. Profit and Loss Percentage Formula from Cost price and Sell Price. It is calculated by dividing the operating profit by total revenue and expressing it as a percentage. 3000 And Rs 2500 respectively.

Lets understand the application of these formulae with the following simple example. It is the percentage of selling price that is turned into profit whereas profit percentage or markup is the percentage of cost price that one gets as profit on top of cost priceWhile selling something one should know what percentage of profit one will get on a particular investment so. These events are also known as dine-to-donate profit shares fundraising nights restaurant give-back nights or.

For example an investor can see Mrs. The markup percentage on the other hand would be calculated by dividing the gross profit 5 by the sales price 10 which coincidentally would also equate to 50. Chapter 10 Profit and Loss Test Paper.

For example 001 equals 1 01 equals 10 percent and 10 equals 100 percent. The net profit is. Profit margin is calculated with selling price or revenue taken as base times 100.

To calculate the percentage profit you need to have the profit itself and the cost price. In other words given a price of 500 and a cost of 400 we want to return a profit margin of 20. Hope you understood how to calculate the Percentage margin profit of a set of values.

As you can see in the above snapshot first data percentage of profit margin is 8. PERCENTAGE OF COST BREAKDOWN BETWEEN LABOUR MATERIALS AND CONTRACTOR PROFIT IN CONSTRUCTION. Chapter 10 Profit and Loss Ex 10D.

ABCs 65 percent gross profit margin and compare it to XYZs gross profit margins even though XYZ is a billion-dollar firm. Markup and gross profit percentage are not the same. These are projects such as 6 storey and above high rise buildings in major towns such as in UpperHill area and over 10km.

2306d and 41 USC. Gross profit percentage formula Total sales Cost of goods sold Total sales 100. The percentage of discount given by the company A is twice the discount percentage given by company B.

A restaurant fundraiser is a social event where a group eats at a restaurant on a particular day and the restaurant donates back a set percentage of sales to the groups cause. Find out what percentage of the full benefit youre eligible for based on. RS Aggarwal Solutions Class 7 Chapter 12 Simple Interest.

360 then sold it at K sh. Now we need to calculate the profit percentage. Calculate the percentage profit.

Subtract the cost of the voucher from the price received from its sale. Terminology speaking markup percentage is the percentage difference between the actual cost and the selling. In large constructions costing kes 500m and above a modest profit of between 10 to 20 is desirable.

First click on cell E5 and type the following formula. Company Cs profit is 10 times its percentage of discount. RS Aggarwal Solutions Class 7 Chapter 10 Percentage.

After covering the cost of goods sold the remaining money is used to service other operating expenses like sellingcommission expenses general and administrative expenses Administrative Expenses Administrative expenses are indirect costs incurred by a business that are not directly related. How to calculate percentage profit. Chapter 9 Percentage Exercise 9B.

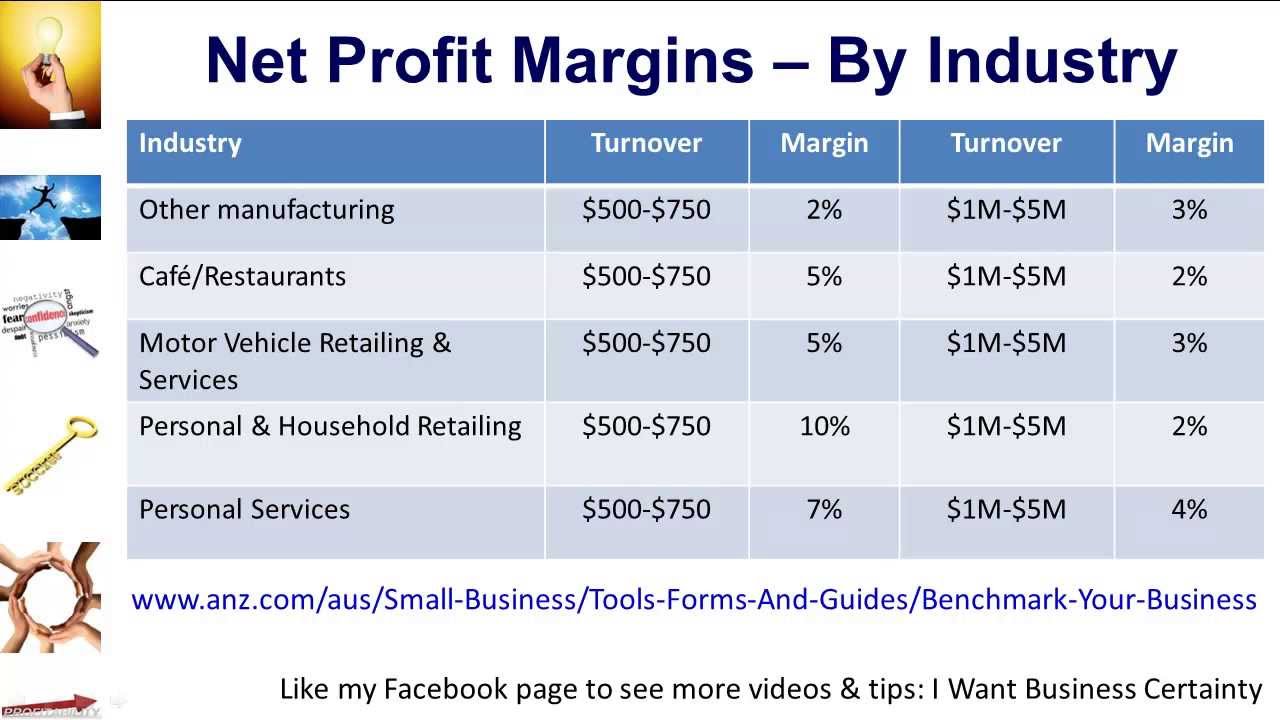

Ie 20 means the firm has generated a net profit of 20 for every 100 sale. Investors are typically interested in gross profit margins as a percentage because this shows them to compare margins between peer companies no matter their sales volume or size. The cost of nurse turnover can have a huge impact on a hospitals profit margin.

These resources account for the cost of goods sold COGS that companies depend on for operational processes. Turnover statistics for bedside RNs in 2014 were 164 percent and they rose to 172 percent in 2015. For the discussion of profit we note that USC.

Gross margin is the difference between revenue and cost of goods sold COGS divided by revenue. Chapter 11 Profit and Loss Exercise 11A. Chapter 9 Percentage Exercise 9A.

Gross margin is expressed as a percentageGenerally it is calculated as the selling price of an item less the cost of goods sold e. In this method we will use the mathematical formula subtraction to simply get the result of profit or loss and then use percentage formatting from the Number Format ribbon. COGS can account for expenses.

The gross profit percentage measures how efficiently companies allocate resources to create and sell products. To calculate the Gross Profit Margin percentage divide the price received for the sale by the gross profit and convert the decimals into a percentage. We begin by calculating the profit.

A vendor purchased a book for 100 and sold it for 125. Operating Profit Margin is a profitability or performance ratio that reflects the percentage of profit a company produces from its operations before subtracting taxes and interest charges. A vendor bought a tray of eggs at K sh.

Under a cost-plus-fixed-fee contract the cap is 15 percent for fee for experimental developmental or research work 6 percent for fee for architect-engineer services for public works or utilities and. It measures the ability of the firm to convert sales into profits. Chapter 11 Profit and Loss CCE Test Paper.

Copy the formula in the remaining cells to get the percentage change of profit margin for the rest of the data. According to the 2016 National Healthcare Retention RN Staffing Report. Profit percentage is a top-level and the most common tool to measure the profitability of a business.

Chapter 10 Percentage Exercise 10A. A clear understanding and application of the two within a pricing model can have a drastic impact on the bottom line. The prices of A B and C are Rs.

Profit Percentage Markup Net Profit SP CPCost Price CP X 100. Production or acquisition costs not including indirect fixed costs like office expenses rent or administrative costs then divided by the same. Profit Percentage Margin Net Profit SP CPSelling Price SP X 100.

Each item in the table has different price and cost so the profit varies across items. The gross profit percentage takes the rate at which companies use COGS to generate profit. Chapter 11 Profit and Loss Exercise 11B.

If you served on active duty for less than 36 months youre not eligible for the full Post-911 GI Bill benefit. Chapter 10 Profit and Loss Ex 10C. Profit margin percent can be calculated using the above method.

254 b impose certain statutory limitations with respect to profit. 5 10 50 Therefore gross margin and markup are simply two different accounting terms that show different information by analyzing the same transaction just in a. In this example the goal is to calculate and display profit margin as a percentage for each of the items shown in the table.

The difference is gross profit. Chapter 9 Percentage Exercise 9C. RS Aggarwal Solutions Class 7 Chapter 11 Profit and Loss.

Eligibility for a percentage of benefits based on how long you served on active duty. Theres more than one way to set up a business officially. Learn the differences between business types so you can pick the one thats right for you.

The turnover rate for RNs continues to rise. RS Aggarwal Maths Book Class 8 Solutions Chapter 10 Profit and Loss. Chapter 10 Profit and Loss Ex 10A.

How To Calculate Percentage Profit General Knowledge Facts Percentage Profit

Pin On Profit And Loss Beginners 1

Column Chart Gauge Chart Illustrating The Financial Kpi Operating Profit Margin Percentage Kpi Company Finance Finance

Red Baragon Partnership Pricing Have A Mobile App Idea Partner With Us Appideas Tech Pricing Startup Infographi Mobile App Profit Shares Marketing Cost

Profit And Loss Rs Aggarwal Class 7 Maths Solutions Exercise 11a Maths Solutions Math Formula Chart Math Methods

Pin By Vpuzzles On Finance And Insurance Math Questions Formula Math

Profit Margins In The Era Of Unprofitable Tech Platforms Fourweekmba Financial Ratio Netflix Business Model Profit

Finding A Percentage Change Profit And Loss Math For Kids Fun Math Classroom Posters

How To Use Profit First Accounting System By Mike Michalowicz Free Calculator Spreadsheet Youtube In 2022 Free Spreadsheets Money Management Advice Accounting

How Do You Find Percentage Profit Or Loss Maths Formula Book Math Formulas Find Percentage

Turnover Vs Profit Turnovers Profit Context

Gross Profit Percentage Meaning Example Advantages And More Accounting Education Learn Accounting Economics Lessons

Simple Numbers Straight Talk Big Profits By Greg Crabtree Chapter 2 Profit Why 10 Percent Is The New Breakeven Revenue Is F Profit The Unit Chapter

Profit And Loss Basics And Methods Examples Math Tricks Math Tricks Math Basic

Profit And Loss Basics And Methods Examples Math Tricks Math Tricks Math Basic

Profit Margins In The Era Of Unprofitable Tech Platforms Fourweekmba Business Strategy Netflix Business Model Business

Profitability Strategy To Rocket Your Net Profit Business Development Strategy Profit Margins Business Development Strategy Net Profit Business Development